UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | ☒ | Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to |

Muscle Maker, Inc.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement if other thanOther Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1l (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Muscle Maker, Inc.

2600 South Shore Blvd.,1751 River Run, Suite 300200

League City,Fort Worth, Texas 7757376107

| January 25, 2023 |

Dear Fellow Stockholder:

You are cordially invited to attend a special meeting of stockholders of Muscle Maker, Inc. to be held at 10:00 a.m. (central time) on February 28, 2023, at the Hampton Inn & Suites, 13251 Jake Court, Fort Worth, Texas 76028.

As previously announced, on October 19, 2022, Muscle Maker, Inc. (“Muscle Maker” or the “Company”) formed Sadot LLC, a Delaware limited liability company and a wholly owned subsidiary of the Company (“Sadot”). On November 14, 2022 (the “Effective Date”), the Company, Sadot and Aggia LLC FC, a company formed under the laws of United Arab Emirates (“Aggia”) entered into a Services Agreement (the “Services Agreement”), which is attached hereto and incorporated herein as Annex A, whereby Sadot engaged Aggia to provide certain advisory services to Sadot for creating, acquiring and managing Sadot’s business of wholesaling food and engaging in the purchase and sale of physical food commodities. The closing date of the Services Agreement was November 16, 2022. The parties entered into Addendum 1 to the Services Agreement (“Addendum 1”) on November 17, 2022, which is attached hereto and incorporated herein as Annex B. The above is hereinafter described as the Sadot Transaction.

August 23, 2021As consideration for Aggia providing the services to Sadot, the Company agreed to issue shares of common stock of the Company, par value $0.0001 per share (the “Common Stock”), to Aggia subject to Sadot generating net income measured on a quarterly basis at a per share price of $1.5625, subject to equitable adjustments for any combinations or splits of the Common Stock occurring following the Effective Date (the “Per Share Price”). Upon Sadot generating net income for any fiscal quarter, the Company shall issue Aggia a number of shares of Common Stock equal to the net income for such fiscal quarter divided by the Per Share Price (the “Shares”). The Company may only issue authorized, unreserved Shares of Common Stock. The Company will not issue Aggia in excess of 14,424,275 Shares representing 49.999% of the number of issued and outstanding shares of Common Stock as of the Effective Date (the “Shares Cap”). Further, once Aggia has been issued a number of Shares constituting 19.99% of the issued and outstanding shares of Common Stock of the Company, no additional Shares shall be issued to Aggia unless and until this transaction has been approved by the shareholders of the Company. In the event that the Shares Cap has been reached, then the remaining portion of the net income, if any, not issued as Shares shall accrue as debt payable by Sadot to Aggia (the “Debt”) until such Debt has reached a maximum of $71,520,462 (the “Debt Cap”). The Company shall determine Sadot’s net income or net loss, as applicable, on a quarterly basis. Aggia will have ten days to object to such determination in writing. In the event the parties are unable to resolve any dispute, then such dispute will be resolved through arbitration. The Debt shall be represented by one or more promissory notes of Sadot issued to Aggia. Such promissory note or notes will be non-interest bearing and will be due and payable seven years from issuance. All positive net income shall remain in Sadot for further investment into the Sadot business, provided, however, that such net income as required to repay the Debt pursuant to the terms of the Debt shall be utilized by Sadot for such purposes. After Sadot has generated $9.9 million in net income, the costs incurred by Aggia for the engagement of all employees or consultants of Aggia hired for running the business of Sadot as well as any travel expenses or other expenses incurred for such work shall be reimbursed to Aggia by Sadot to the extent then accrued and shall be reimbursed thereafter.

Dear Stockholders:

On behalf ofSubject to the below net income thresholds, Aggia will have the right to nominate up to eight directors (the “Designated Directors”) to the Board of Directors I cordially invite you to attend the 2021 annual meeting of stockholders (the “Annual Meeting”“Board”) of Muscle Maker, Inc.,the Company, seven of which will meet the independence requirements of the NASDAQ Capital Market and the Company will take such actions as reasonably required to name the directors which Aggia has the right to nominate to the Board. Pursuant to the terms of the Services Agreement, Aggia nominated Benjamin Petel as the initial Designated Director (the “Initial Director”). As it was not feasible for Aggia to nominate Mr. Petel at the Closing, pursuant to the terms of Addendum 1, the parties agreed that Mr. Petel will be helddeemed to be the Initial Director and the “Managing Member Representative” for all purposes of the Services Agreement until such time as the parties mutually agree that it is feasible for Aggia to nominate Mr. Petel as the Initial Director. Mr. Petel was appointed to the Board on October 7, 2021, beginning at 10:00 a.m., Central Time at Springhill Suites DFW North Grapevine, 2240 W. Grapevine Mills Circle, Grapevine, TX 76051.December 27, 2022. Other than as set forth in Addendum 1, the Services Agreement remains in full force and effect.

Upon Sadot generating an initial $3.3 million in net income, Aggia shall nominate two additional persons as directors of the Board. Upon Sadot generating a total of $6.6 million in net income, Aggia shall nominate two additional persons as directors of the Board. Upon Sadot generating a total of $9.9 million in net income, Aggia shall nominate three additional persons as directors of the Board. All candidates as Designated Directors will be subject to the reasonable acceptance of the Board and appropriate background checks.

The term of the Services Agreement shall commence on the Effective Date and continue until terminated by joint written agreement of Aggia and the Company, automatically in the event that the Shareholder Matters fail to receive the requisite vote needed to approve such matters and by the Company at any time prior to the date that Sadot has generated $9.9 million in net income if Sadot has failed to generate net income for three consecutive quarters during the two years following the formation of Sadot or the accrued amount of Debt has not reached the Debt Cap during the two years following the formation of Sadot. In the event the Services Agreement is terminated, then, at the election of Aggia, Sadot will make a payment to Aggia equal to the net income generated by Sadot from the Closing Date through the date of such termination less any supportable incremental cost that the Company and Sadot would not have incurred that is attributable to Sadot or Aggia will retain the Shares it has received prior to such termination. Further, upon termination, the Company shall sell to Aggia its membership interest in Sadot for a purchase price of $1.00 in total.

On November 16, 2022, the Company entered into a Limited Liability Operating Agreement (the “Operating Agreement”) for Sadot, which is attached hereto and incorporated herein as Annex C, pursuant to which the Company, as the sole member of Sadot, appointed itself as the managing member. As it was not feasible for Aggia to nominate Mr. Petel at the Closing, pursuant to the terms of Addendum 1, the parties agreed that Mr. Petel will be deemed to be the Initial Director and the “Managing Member Representative” for all purposes of the Services Agreement until such time as the parties mutually agree that it is feasible for Aggia to nominate Mr. Petel as the Initial Director. Mr. Petel was appointed to the Board on December 27, 2022. Upon appointment, the Initial Director will act as the managing member representative who shall have the right to make any decisions for the Company with respect to Sadot subject to Sadot’s protocol for managing its business. The Initial Director may be terminated as managing member representative at any time and shall be automatically terminated in the event the Initial Director no longer serves as a director of the Company.

The terms of this transaction require us to submit certain matters for stockholder approval in accordance with the Securities and Exchange Commissionapplicable Nasdaq listing rules, allowing companies to furnish proxy materials to their stockholders over the Internet, we have sent stockholders of record at the close of business on August 16, 2021 the Proxy Materials including our Proxy Statement and Annual Report and instructions on how vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice, as well as for other corporate law purposes. The proxy statement and proxy card accompanying this letter describe in detail this transaction and the attached Proxy Statement.matters to be acted upon at the meeting. We urge you to read these materials carefully.

Attached to this letter are a Notice of Annual Meeting of Stockholders and Proxy Statement, which describe the business to be conducted at the meeting.

Your vote is important to us. Please act as soon as possible to vote your shares. It is important that your shares be represented at the meeting whethermeeting. Whether or not you plan to attend, the annual meeting. Please vote electronically over the Internet, by telephone or if, you receive a paper copy of the proxy card by mail, by returning your signed proxy card in the envelope provided. We encourage you toplease vote by proxy so that your shares will be represented and votedusing the Internet at the meeting, whetherwww.proxyvote.com, Telephone, or not you can attend.by mail as outlined herein - as soon as possible.

Thank you for your continued support of Muscle Maker, Inc. We look forward to seeing you at the annual meeting.

To be admitted to the Annual Meeting you must have your control number available and follow the instructions found on your proxy card or voting instruction form. You may vote during the Annual Meeting but suggest you vote beforehand.

Proxy materials or a Notice of Internet Availability of Proxy Materials (the “Notice”) are being first released or mailed on or about August 23, 2021, to all shareholders entitled to vote at the Annual Meeting. In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each record shareholder, we may furnish proxy materials by providing internet access to those documents. The Notice contains instructions on how to access our proxy materials and vote online, or in the alternative, request a paper copy of the proxy materials and a proxy card.

Muscle Maker, Inc.

2600 South Shore Blvd., Suite 300

League City, Texas 77573

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 7, 2021

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Muscle Maker, Inc., a Nevada corporation, will be held on October 7, 2021, at 10:00 a.m., Central Time Springhill Suites DFW North Grapevine, 2240 W. Grapevine Mills Circle, Grapevine, TX 76051.

The Annual Meeting is being held to consider the following proposals:

These items of business are described in the Proxy Statement that follows this notice. Holders of record of our common stock as of the close of business on August 16, 2021 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment thereof.

Your vote is important. Voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Please promptly vote your shares by following the instructions for voting on the Notice Regarding the Availability of Proxy Materials or, if you received a paper or electronic copy of our proxy materials, by completing, signing, dating and returning your proxy card or by Internet or telephone voting as described on your proxy card.

All stockholders are cordially invited to attend the annual meeting. Whether you plan to attend the annual meeting or not, we urge you to vote by following the instructions in the Notice of Internet Availability of Proxy Materials that you previously received and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the meeting.

Please note that space limitations make it necessary to limit attendance of the Annual Meeting to our stockholders. Registration and seating will begin at 9:30 a.m. Shares of common stock can be voted at the Annual Meeting only if the holder thereof is present in person or by valid proxy. For admission to the Annual Meeting, each stockholder may be asked to present valid picture identification, such as a driver’s license or passport, and proof of stock ownership as of the record date, such as the enclosed proxy card or a brokerage statement reflecting stock ownership. Cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting. If you do not plan on attending the Annual Meeting, please vote, date and sign the enclosed proxy and return it in the business envelope provided. Even if you do plan to attend the Annual Meeting, we recommend that you vote your shares at your earliest convenience in order to ensure your representation at the Annual Meeting. Your vote is very important.

| /s/ Michael Roper | |

| Michael Roper | |

| Chief Executive Officer |

Burleson, TexasThis proxy statement and the accompanying proxy card are

August 23,being mailed to our stockholders beginning on or about January 25, 2023.

2021Even though you may plan to attend the meeting in person,

please vote by Internet, Phone or Mail promptly. A postage-paid return

envelope is enclosed for your convenience.

Muscle Maker, Inc.

1751 River Run, Suite 200

Fort Worth, Texas 76107

NOTICE OF SPECIAL MEETING OF

THE STOCKHOLDERS

TO BE HELD February 28, 2023

Fort Worth, Texas January 25, 2023 |

Dear Stockholder:

Notice is hereby given that a special meeting of stockholders of Muscle Maker, Inc. (the “Company,” “Muscle Maker,” “us” or “we”) will be held at 10:00 a.m. (central time) on February 28, 2023 at the Hampton Inn & Suites, 13251 Jake Court, Fort Worth, Texas 76028, to consider and act upon the following matters:

1. To approve the Services Agreement and the Sadot Transaction contemplated therein;

2. To approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the authorized number of shares of our Common Stock from 50,000,000 to 150,000,000;

3. To approve, for purposes of complying with NASDAQ Listing Rule 5635(b), the issuance of the Shares pursuant to the Services Agreement entered between the Company, Sadot and Aggia representing more than 20% of our common stock outstanding, which would result in a “change of control” of the Company under applicable Nasdaq listing rules;

4. To approve, for purposes of complying with NASDAQ Listing Rule 5635(c), the issuance of up to 14,424,275 Shares of Common Stock to Aggia pursuant to the Services Agreement and net income generated thresholds;

5. To approve the right of Aggia to nominate up to eight directors to the Board of Directors subject to achieving net income thresholds as set forth in the Services Agreement;

6. To approve our 2023 Equity Incentive Plan; and

7. To transact such other business as may properly come before the meeting or any adjournment thereof.

Stockholders of record at the close of business on January 19, 2023, the record date for the special meeting, are entitled to notice of and to vote at the special meeting and any adjournment or postponement of the meeting.

This Notice of AnnualSpecial Meeting, and Proxy Statement and accompanying proxy card are first being distributed or made available, as the case may be,to stockholders on or about August 23, 2021.January 25, 2023.

| By Order of the Board of Directors. | |

| MUSCLE MAKER, INC. | |

| /s/ Kevin Mohan | |

| Kevin Mohan | |

| Chairman of the Board of Directors | |

| Fort Worth, Texas | |

| January 25, 2023 |

| 2 |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting:ThisSpecial Meeting of Stockholders to be Held on February 28, 2023

The Proxy Statement for the Special Meeting of Stockholders is available to be viewed, downloaded, and our Annual Reportprinted, at no charge, by accessing the following Internet address: http://www.musclemakergrill.com/investor-relations/. If you have any questions about accessing these materials via the Internet, please contact the secretary at (832) 604-9568 or email us at IR@musclemakergrill.com.

This proxy statement and the accompanying proxy card are available free of charge at www.proxyvote.com.

being mailed to Muscle Maker stockholders beginning on or about January 25, 2023.

| 3 |

TABLE OF CONTENTSMUSCLE MAKER, INC.

1751 River Run, Suite 200

Fort Worth, Texas 76107

(832) 604-9568

Muscle Maker, Inc.

2600 South Shore Blvd., Suite 300

League City, Texas 77573

PROXY STATEMENT

FOR THE ANNUAL

SPECIAL MEETING OF THE STOCKHOLDERS

TO BE HELD ON OCTOBER 7, 2021February 28, 2023

AT HAMPTON INN & SUITES, 13251 JAKE COURT, FORT WORTH, TEXAS 76028

This proxy statement is furnished to the holders of common stock of Muscle Maker, Inc. (“Muscle Maker” or the “Company”) in connection with the solicitation of proxies for use in connection with the Special Meeting of the stockholders of Muscle Maker Common Stock (the “Proxy Statement”“Stockholders”) to be held February 28, 2023, and our annual reportall adjournments and postponements thereof, for the fiscal year ended December 31, 2020 (the “Annual Report”purposes set forth in the accompanying Notice of Special Meeting of the Stockholders. Muscle Maker is first mailing this proxy statement and togetherthe enclosed form of proxy to Stockholders on or about January 25, 2023.

The Sadot Transaction contemplated by the Services Agreement will be terminated unless all of the proposals are approved. The term of the Services Agreement shall commence on the Effective Date and continue until terminated. The Services Agreement will automatically terminate in the event that any of the proposals fail to receive the requisite vote needed to approve such matters. In the event the Services Agreement is terminated, then, at the election of Aggia, Sadot will make a payment to Aggia equal to the net income generated by Sadot from the Closing Date through the date of such termination less any supportable incremental cost that the Company and Sadot would not have incurred that is attributable to Sadot or Aggia will retain the Shares it has received prior to such termination. Further, upon termination, the Company shall sell to Aggia its membership interest in Sadot for a purchase price of $1.00 in total. Your vote is very important. Whether or not you plan to attend the Special Meeting, we request that you vote as soon as possible. Whether or not you expect to be present in person at the meeting, you are requested to vote in accordance with the procedures set forth herein. If you attend the meeting, you may vote by ballot. If you do not attend the meeting, your shares of Common Stock can be voted only when represented by a properly executed proxy.

Any person giving such a proxy has the right to revoke it at any time before it is voted as set forth below. Your most recent proxy card or telephone or Internet proxy is the one that is counted. Your attendance at the Special Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Company before your proxy is voted or you vote at the Special Meeting.

The close of business on January 19, 2023 has been fixed as the record date for the determination of the Stockholders entitled to vote at the Special Meeting of the Stockholders. As of the record date, 29,318,520 shares of Muscle Maker common stock were outstanding and entitled to be voted at the Special Meeting. Stockholders will be entitled to cast one vote on each issue presented above for each share of Muscle Maker common stock held of record on the record date.

The solicitation of this proxy is made by Muscle Maker.The proxies being solicited hereby are being solicited by the Company. The Company will bear the entire cost of solicitation of proxies including preparation, assembly, printing and mailing of the Proxy Statement, the “proxy materials”) are being furnished byProxy card and on behalfestablishment of the boardInternet site hosting the proxy material. We have engaged Morrow Sodali to assist us in the solicitation of directors (the “Board” orvotes described above. We will bear the “Boardcosts of Directors”)the fees for the solicitation agent, which includes a fee of Muscle Maker, Inc. (the “Company,” “Muscle Maker,” “we,” “us,” or “our”), in connection$20,000 and a fee of $6.50 per proxy solicitation call with our 2020 annual meetingshareholders. Copies of stockholders (the “Annual Meeting”).solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of common stock beneficially owned by others to forward to such beneficial owners. Officers and regular employees of the Company may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, telex, facsimile or electronic means. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of stock.

| 4 |

GENERAL INFORMATION ABOUT THE ANNUALSPECIAL MEETING AND VOTING

When and where will the Annual Meeting be held?Q. Why am I receiving these materials?

The AnnualBoard of Directors (the “Board”) of the Company is soliciting proxies from the Company’s stockholders in connection with the Special Meeting willof Stockholders to be held on October 7, 2021 at 10:00 a.m., Central Time at Springhill Suites DFW North Grapevine, 2240 W. Grapevine Mills Circle, Grapevine, TX 76051.

February 28, 2023 and any and all adjournments and postponements thereof. You are encouraged to vote on the proposals presented in these proxy materials. You are invited to attend the Special Meeting, but you do not have to attend to vote.

Notice of Internet Availability (Notice

Q. When and Access)where is the Special Meeting?

InsteadWe will hold the Special Meeting of mailing a printed copy of our proxy materials to each shareholder, we are furnishing proxy materials via the Internet. This reduces both the costs and the environmental impact of sending our proxy materials to our shareholders. If you received a “Notice of Internet Availability,” you will not receive a printed copy of the proxy materials unless you specifically request a printed copy. The Notice of Internet Availability will instruct you how to access and review all of the important information contained in the proxy materials. The Notice of Internet Availability also instructs you how to submit your proxyStockholders on the Internet and how to vote by telephone.

If you would like to receive a printed or emailed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability. In addition, if you received paper copies of our proxy materials and wish to receive all future proxy materials, proxy cards and annual reports electronically, please follow the electronic delivery instructions on www.proxyvote.com. We encourage shareholders to take advantage of the availability of the proxy materials on the Internet to help reduce the cost and environmental impact of our annual shareholder meetings.

The Notice of Internet Availability is first being sent to shareholders on or about August 23, 2021. Also on or about August 23, 2021, we will first make available to our shareholders this Proxy Statement and the form of proxy relating to the 2021 Annual Meeting filed with the SEC on August 23, 2021.

What are the purposes of the Annual Meeting?

The purpose of the Annual Meeting is to vote on the following items described in this Proxy Statement:

Are there any matters to be voted onFebruary 28, 2023, at 10:00 a.m. (central time) at the Annual Meeting that are not included in this Proxy Statement?Hampton Inn & Suites, 13251 Jake Court, Fort Worth, Texas 76028.

At the date this Proxy Statement was filed with the SEC, we did not know of any matters to be properly presented at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the meeting or any adjournment or postponement thereof for consideration, and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

What is included in these materials?

These materials include:

What does it mean if I receive more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

Q. Who is entitled to vote at the Annual Meeting?meeting?

HoldersYou are entitled to vote (in person or by proxy) if you were a stockholder of record of shares of our common stock as ofat the close of business on August 16, 2021January 19, 2023 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement or adjournment thereof. At the close of business on the record date,. On January 19, 2023 there were 17,720,36429,318,520 shares of our common stock issued and outstanding and entitled to vote. Each share

Q. What am I being asked to vote on at the meeting?

You will be voting on the following proposals: (i) to approve the Services Agreement and the Sadot Transaction contemplated therein; (ii) To approve an amendment to the Company’s Articles of Incorporation, as amended, to increase the authorized number of shares of our Common Stock from 50,000,000 to 150,000,000; (iii) to approve, for purposes of complying with NASDAQ Listing Rule 5635(b), the issuance of the Shares pursuant to the Services Agreement entered between the Company, Sadot and Aggia representing more than 20% of our common stock is entitledoutstanding, which would result in a “change of control” of the Company under applicable Nasdaq listing rules; (iv) to oneapprove, for purposes of complying with NASDAQ Listing Rule 5635(c), the issuance of up to 14,424,275 Shares of Common Stock to Aggia pursuant to the Services Agreement and subject to achieving net income thresholds; (v) to approve the right of Aggia to nominate up to eight directors to the Board of Directors subject to achieving net income thresholds as set forth in the Services Agreement and (vi) to approve the 2023 Equity Stock Incentive Plan. In addition, the proxies will be authorized to vote on such other business that may properly come before the Special Meeting, including any matter presented to stockholders at the Annual Meeting. You will need to obtain your own Internet access if you choose to attend the Annual Meeting online and/or vote over the Internet.

Only record holders and beneficial owners of our common stock, or their duly authorized proxies, may attend the Annual Meeting. If your shares of common stock are held in street name, you will need to bring a copy of a brokerage statement or other documentation reflecting your stock ownership as of the Record Date.

adjournment thereof.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder (also called a “registered holder”) holds shares in his or her name. Shares held in “street name” means that shares are held in the name of a bank, broker or other nominee on the holder’s behalf.

What do I do if my shares are held in “street name”?

If your shares are held in a brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “street name.” The proxy materials, if you elected to receive a hard copy, has been forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by following their instructions for voting. Please refer to information from your bank, broker or other nominee on how to submit your voting instructions.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The holders of a majority in voting power of our capital stock issued and outstanding and entitled to vote, present in person, or by remote communication, or represented by proxy constitutes a quorum. If you sign and return your paper proxy card or authorize a proxy to vote electronically or telephonically, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote as indicated in the proxy materials.

Broker non-votes will also be considered present for the purpose of determining whether there is a quorum for the Annual Meeting.

What are “broker non-votes”?

A “broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the authority to vote the shares at their discretion.

Under current New York Stock Exchange (“NYSE”) interpretations that govern broker non-votes, Proposal No. 1 for the election of directors is considered a non-discretionary matter, and a broker will lack the authority to vote uninstructed shares at their discretion on such proposal. Proposals No. 2 and 4 are considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on the proposal.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present or represented at the scheduled time of the Annual Meeting, (i) the chairperson of the Annual Meeting or (ii) a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present electronically or represented by proxy, may adjourn the Annual Meeting until a quorum is present or represented.

Q. How do I vote my shares without attending the Annual Meeting?vote?

We recommend that stockholders vote by proxy even if they plan to attend the AnnualSpecial Meeting and vote electronically. If you are a stockholder of record, there are four ways to vote by proxy:

| ● | by Telephone—You can vote by telephone by calling 1-800-690-6903 following the instructions on the proxy card; | |

| ● | by Internet-You can vote over the Internet at www.proxyvote.com and follow the instructions set forth on the internet site or scan the QR code with your smartphone. Have your proxy card available when you access the web page; | |

| ● | by Mail-You can vote by mail by signing, dating and mailing the proxy card, which you may have received by mail; or | |

| ● | In Person -You may attend and vote at the |

Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Central Time, on October 6, 2021.February 27, 2023.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions on how to vote from the bank, broker or holder of record. You must follow the instructions of such bank, broker or holder of record in order for your shares to be voted.

How canQ. What if I attend and vote at the Annual Meeting?want to change my vote?

The Annual Meeting will be held at October 7, 2021. If you were a stockholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting.

How does the Board recommend that I vote?

The Board recommends that you vote:

How many votes are required to approve each proposal?

The table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

| ||||||||

|

|

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are set forth above, as well as with the description of each proposal in this Proxy Statement.

Can I revoke or change my vote after I submit my proxy?

Yes. Whether you have voted by Internet, telephone or mail, if you are a stockholder of record, you may change your vote and revoke your proxy by:

| ● | sending a written statement to that effect to the attention of our Secretary at our corporate offices, provided such statement is received no later than | |

| ● | by telephone by dialing 1-800-690-6903 using a touchtone telephone and following the recorded | |

| ● | voting again by Internet at a later time before the closing of those voting facilities at 11:59 p.m., Central time, on | |

| ● | submitting a properly signed proxy card with a later date that is received no later than | |

| ● | attending the Annual Meeting, revoke your proxy and voting again. |

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your proxy at the AnnualSpecial Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

Your most recent proxy card or telephone or Internet proxy is the one that is counted. Your attendance at the AnnualSpecial Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Company before your proxy is voted or you vote at the AnnualSpecial Meeting.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

How can I Find out the Results of the Voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be disclosed in a Current Report on Form 8-K that we expect to file with the Securities and Exchange Commission (“SEC”) within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

| 5 |

PROPOSAL NO. 1 ELECTION OF DIRECTORSQ. What vote of the stockholders is required to approve the Proposals?

Board SizeProposal 2 will be approved if a quorum is present and Structure

Our boarda majority of directors currently consists of seven (7) directors. We have nominated the below seven (7) directors to serve for the following year. Our articles of incorporation, as amended, provides that the number of directors on our board of directors shall be fixed exclusively by resolution adopted by our board of directors.

When considering whether directors have the experience, qualifications, attributes or skills, taken as a whole, to enable our board of directors to satisfy its oversight responsibilities effectively in light of our business and structure, the board of directors focuses primarily on each person’s background and experience as reflected in the information discussed in eachshares of the directors’ individual biographies set forth below. We believe that our directors provide an appropriate mixcommon stock outstanding as of experiencethe Record Date are cast in favor of the proposal. Proposals 1, 3, 4, 5 and skills relevant to the size and nature of our business.

Nominees for Director

Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee6 will be unable to serve. If, however, prior to the Annual Meeting, the Board of Directors should learn that any nominee will be unable to serve for any reason, the proxies that otherwise would have been voted for this nominee will be voted forapproved if a substitute nominee as selected by the Board. Alternatively, the proxies, at the Board’s discretion, may be voted for that fewer number of nominees as results from the inability of any nominee to serve. The Board has no reason to believe that anyquorum is present and a majority of the nominees will be unable to serve.

Information About Board Nominees

The following pages contain certain biographical information asvotes cast by holders present in person or represented by proxy are cast in favor of August 23, 2021 for each nominee for director, including all positions he holds, his principal occupation and business experience for the past five years, and the names of other publicly-held companies of which the director or nominee currently serves as a director or has served as a director during the past five years.applicable proposal.

Kevin Mohan.Q. What do I do if my shares of common stock are held in “street name” at a bank or brokerage firm?

If your shares are held in an account at a brokerage firm, bank, broker-dealer, trust or other similar organization, like the vast majority of our stockholders, you are considered the beneficial owner of shares held in street name, and the Proxy was forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee or nominee how to vote your shares and you are also invited to attend the Special Meeting.

Q. What are abstentions and broker non-votes?

While the inspector of elections will treat shares represented by proxies that reflect abstentions or include “broker non-votes” as shares that are present and entitled to vote for purposes of determining the presence of a quorum, abstentions or “broker non-votes” do not constitute a vote “for” or “against” any matter and thus will be disregarded in any calculation of “votes cast.” However, abstentions and “broker non-votes” will have the effect of a negative vote if an item requires the approval of a majority of a quorum or of a specified proportion of all issued and outstanding shares.

Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received voting instructions from its customers on a proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter. Under New York Stock Exchange (“NYSE”) rules, if your shares are held by a member organization, as that term is defined under NYSE rules, responsibility for making a final determination as to whether a specific proposal constitutes a routine or non-routine matter rests with that organization, or third parties acting on its behalf.

Q. What do I need to do if I plan to attend the meeting in person?

All stockholders must present a form of personal identification in order to be admitted to the meeting. If your shares are held in the name of a bank, broker or other holder of record, you also must present proof of your ownership, such as a bank or brokerage account statement, to be admitted to the meeting.

Q. How does the Board recommend that I vote?

The Board recommends that you vote FOR each of the proposals contained herein.

Q. Why is the board recommending approval of each of the proposals?

After evaluating the Sadot Transaction contemplated by the Services Agreement management of the Company believed it is advisable and in the best interests of the Company and recommended the Sadot Transaction to the Board. Based upon the recommendation of management, the Board approved the Sadot Transaction and the Services Agreement and the transaction contemplated thereunder, declared each of the foregoing advisable and in the best interests of the Company and determined to submit it to the stockholders of the Company. The board recommends that the stockholders vote “FOR” each of the proposals set forth in this proxy statement. In making this recommendation, the board considered a number of factors, including the following:

| ● | The goal of creating additional shareholder value. | |

| ● | The potential financial impact to the Company. | |

| ● | Resource requirements to execute new diversification strategy. | |

| ● | Risks associated with food commodity trading, farming, sourcing and other aspects of the transaction. |

Q. What happens if stockholders do not approve any of the proposals?

The Sadot Transaction contemplated by the Services Agreement will be terminated unless all of the proposals are approved. The term of the Services Agreement shall commence on the Effective Date and continue until terminated. The Services Agreement will automatically terminate in the event that the any of the proposals fail to receive the requisite vote needed to approve such matters. In the event the Services Agreement is terminated, then, at the election of Aggia, Sadot will make a payment to Aggia equal to the net income generated by Sadot from the Closing Date through the date of such termination less any supportable incremental cost that the Company and Sadot would not have incurred that is attributable to Sadot or Aggia will retain the Shares it has received prior to such termination. Further, upon termination, the Company shall sell to Aggia its membership interest in Sadot for a purchase price of $1.00 in total.

| 6 |

BACKGROUND AND OVERVIEW

Background of the Transaction

On October 19, 2022, Muscle Maker formed Sadot, a Delaware limited liability company and a wholly owned subsidiary of the Company (“Sadot”). On the Effective Date, the Company, Sadot and Aggia entered into the Services Agreement whereby Sadot engaged Aggia to provide certain advisory services to Sadot for creating, acquiring and managing Sadot’s business of wholesaling food and engaging in the purchase and sale of physical food commodities. The closing date of the Services Agreement was November 16, 2022. The parties entered into Addendum 1 on November 17, 2022.

As consideration for Aggia providing the services to Sadot, the Company agreed to issue shares of Common Stock of the Company to Aggia subject to Sadot generating net income measured on a quarterly basis at the Per Share Price or $1.5625, subject to equitable adjustments for any combinations or splits of the Common Stock occurring following the Effective Dat. Upon Sadot generating net income for any fiscal quarter, the Company shall issue Aggia Shares equal to the net income for such fiscal quarter divided by the Per Share Price. The Company may only issue authorized, unreserved Shares of Common Stock. The Company will not issue Aggia in excess of the Shares Cap representing 49.999% of the number of issued and outstanding shares of Common Stock as of the Effective Date. Further, once Aggia has been issued a number of Shares constituting 19.99% of the issued and outstanding shares of Common Stock of the Company, no additional Shares shall be issued to Aggia unless and until this transaction has been approved by the shareholders of the Company. In the event that the Shares Cap has been reached, then the remaining portion of the net income, if any, not issued as Shares shall accrue as the Debt until such Debt has reached the Debt Cap. The Company shall determine Sadot’s net income or net loss, as applicable, on a quarterly basis. Aggia will have ten days to object to such determination in writing. In the event the parties are unable to resolve any dispute, then such dispute will be resolved through arbitration. The Debt shall be represented by one or more promissory notes of Sadot issued to Aggia. Such promissory note or notes will be non-interest bearing and will be due and payable seven years from issuance. All positive net income shall remain in Sadot for further investment into the Sadot business, provided, however, that such net income as required to repay the Debt pursuant to the terms of the Debt shall be utilized by Sadot for such purposes. After Sadot has generated $9.9 million in net income, the costs incurred by Aggia for the engagement of all employees or consultants of Aggia hired for running the business of Sadot as well as any travel expenses or other expenses incurred for such work shall be reimbursed to Aggia by Sadot to the extent then accrued and shall be reimbursed thereafter.

Subject to the below net income thresholds, Aggia will have the right to nominate the Designated Directors to the Board, seven of which will meet the independence requirements of the NASDAQ Capital Market and the Company will take such actions as reasonably required to name the directors which Aggia has the right to nominate to the Board. Pursuant to the terms of the Services Agreement, Aggia agreed to nominate Benjamin Petel as the Initial Director. As it was not feasible for Aggia to nominate Mr. Mohan has servedPetel at the Closing, pursuant to the terms of Addendum 1, the parties agreed that Mr. Petel will be deemed to be the Initial Director and the “Managing Member Representative” for all purposes of the Services Agreement until such time as Chairmanthe parties mutually agree that it is feasible for Aggia to nominate Mr. Petel as the Initial Director. Other than as set forth in Addendum 1, the Services Agreement remains in full force and effect. Upon Sadot generating an initial $3.3 million in net income, Aggia shall nominate two additional persons as directors of the Board. Upon Sadot generating a total of $6.6 million in net income, Aggia shall nominate two additional persons as directors of the Board. Upon Sadot generating a total of $9.9 million in net income, Aggia shall nominate three additional persons as directors of the Board. All candidates as Designated Directors will be subject to the reasonable acceptance of the Board and appropriate background checks

The term of the Services Agreement shall commence on the Effective Date and continue until terminated by joint written agreement of Aggia and the Company, automatically in the event that the Shareholder Matters fail to receive the requisite vote needed to approve such matters and by the Company at any time prior to the date that Sadot has generated $9.9 million in net income if Sadot has failed to generate net income for three consecutive quarters during the two years following the formation of Sadot or the accrued amount of Debt has not reached the Debt Cap during the two years following the formation of Sadot. In the event the Services Agreement is terminated, then, at the election of Aggia, Sadot will make a payment to Aggia equal to the net income generated by Sadot from the Closing Date through the date of such termination less any supportable incremental cost that the Company and Sadot would not have incurred that is attributable to Sadot or Aggia will retain the Shares it has received prior to such termination. Further, upon termination, the Company shall sell to Aggia its membership interest in Sadot for a purchase price of $1.00 in total

On November 16, 2022, the Company entered into the Operating Agreement for Sadot pursuant to which the Company, as the sole member of Sadot, appointed itself as the managing member. The Initial Director acts as the managing member representative who shall have the right to make any decisions for the Company with respect to Sadot subject to Sadot’s protocol for managing its business. The Initial Director may be terminated as managing member representative at any time and shall be automatically terminated in the event the Initial Director no longer serves as a director of Muscle Maker, Inc since April 16, 2018. From April 16, 2018 through May 1, 2018, he also served as the Interim President of the Company. He has also served as the Chief Investment Officer since September 17, 2018. From June 2012 through March 2017, Mr. Mohan served as the VP of Capital Markets for American Restaurant Holdings, Inc., a company focused on acquiring and expanding fast casual restaurant brands.

Based on his experience we have deemed Mr. Mohan fitThe terms of this transaction require us to serve on the Boardsubmit certain matters for stockholder approval in accordance with applicable Nasdaq listing rules, as well as for other corporate law purposes. The notice of special meeting, proxy statement and as Chairman of the Board.

A.B. Southall III. Mr. Southall has served as director of Muscle Maker, Inc since February 2017. He has over 35 years of experience managing construction and land developing businesses. Since 1997 he has been the President of a Custom Home Building Company,proxy card accompanying this letter describe in addition to 20 years as President of a 189 boat slip marina complex. His involvement in the marina business led him to co-founding a local Waterway Association, where he has been on the board since its inception. He has diversely invested across multiple sectors including private placements, oil & gas, real estate, restaurant businesses and commodities. Mr. Southall is an advocate of a healthy approach to the food industrydetail this transaction and the restaurant business.

Based on his vast business and financial experience with real estate and restaurants, we have deemed Mr. Southall fitmatters to serve onbe acted upon at the Board.meeting. We urge you to read these materials carefully.

| 7 |

Paul L. Menchik. Mr. Menchik has served as director of Muscle Maker, Inc since February 2017. Since 1986, Mr. Menchik has been Professor of Economics at Michigan State University where he has been Department chairperson and Director of Graduate Programs. He has served as Senior Economist for Economic Policy for the White House Office of Management and Budget (where among other matters he worked on Social Security solvency issues) and served as Visiting Scholar at the Tax Analysis DivisionApproval of the Congressional Budget Office. Menchik has also been on the faculty of Rutgers UniversitySadot Transaction and the University of Wisconsin, and has served as visiting faculty at University of Pennsylvania, London School of Economics, University College London, and Victoria University in Wellington New Zealand. Over the years he has advised three state governments and five US government agencies. He holds a Ph.D. from the Wharton School of Finance and Commerce at the University of Pennsylvania. He has over 40 publications including a book on household and family economics, made over 85 paper presentations at other universities and conferences around the world and has refereed for over 20 academic journals and is currently a member of the editorial board for the Journal of Income Distribution. He is a member of Who’s Who in Economics and Who’s Who in America. Based on his education and extensive experience in economic and financial matters, we have deemed Mr. Menchik fit to serve on the Board.Services Agreement

The stockholders of the Company are being asked to approve the Services Agreement and the transaction contemplated thereunder. For a detailed discussion of the terms and conditions of the foregoing agreement, including the transaction contemplated thereunder, see the section entitled “Jeff Carl.Background of The Transaction Since 2017, Mr. Carl has served.” A copy of each of the Services Agreement is attached to this proxy statement as Executive Director of Nice & Company, an ad agency with a focus on print, TV, digital, experiential and mobile, and as an independent consultant to the restaurant industry. From 2013 to 2017, Mr. Carl served as the Chief Marketing Officer for Taco Bueno Restaurants and from 2009 to 2013 as the Chief Marketing Officer of Tavistock Restaurants LLC. Mr. Carl received a BA from Wake Forest University in 1977 and a MBA from University of North Carolina Chapel Hill in 1979. Based on his experience within the restaurant industry and due to the fact that he has held senior level executive positions with a focus on advertising and marketing,Annex A. In addition, we have deemed Mr. Carlattached a fit to serve oncopy of the Board.Limited Liability Company Operating Agreement for Sadot LLC, our wholly owned subsidiary.

Stephen A. Spanos. Mr. Spanos has servedApproval of an Amendment to the Articles of Incorporation, as director of Muscle Maker, Inc. since February 2020. Since 2013, Mr. Spanos has provided financial and accounting consulting services for both privately held and public companies. From 2009amended, to 2013, Mr. Spanos served asIncrease the Chief Financial Officer of Orion Seafood International, Inc., a marketer of frozen lobster products, and as the Controller of Reef Point Systems, a provider of security solutions for converged wireless and wireline networks in the United States, from 2005 to 2013. Mr. Spanos served as an audit manager for BDO USA, LLP and as an auditor for Ernst & Young. Mr. Spanos received his MBA and BS in Business Administration, Accounting and Financing in 1995 and 1985, respectively, from Boston University. Based on his education and extensive experience in financial and accounting matters, we have deemed that Mr. Spanos is fit to serve on the Board.Authorized Shares

Major General (ret) Malcolm Frost. Maj. Gen (Ret) Frost has 31 yearsOur current Articles of military experience providing large-scale strategic and operational leadership and oversight inIncorporation, as amended, authorizes us to issue up to 50 million shares of our common stock. As a result, we do not have sufficient authorized but unissued shares for Nevada corporate law purposes to issue common shares when earned by Aggia pursuant to the Indo-Asia-Pacific, Middle East, Europe, andServices Agreement as described above. We agreed with Aggia, as a condition to closing, to seek stockholder approval of an amendment to our Articles of Incorporation, as amended, to increase the United Statesauthorized shares to 150 million, which is being sought with Proposal No. 2.

Approval as Required Pursuant to Nasdaq Listing Rules

Change of Control Rule. Under Nasdaq Listing Rule 5635(b), prior stockholder approval is required for the United States Army - successfully leading the evolutionissuances of soldier training programs in peace and war from platoon through 2-star command level. Maj. Gen. (Ret) Frost has been deployed to combat several timessecurities that will result in a variety“change of leadership and command positions. Since 2019, Maj. Gen. (Ret) Frost served as Executive Consultant for Fortune 500 and larger corporations through Malcolm Frost and Associates LLC. From 2015 through 2019, Maj. Gen. (Ret) Frost served ascontrol” of the Commanding General for the US Army Training and Doctrine Command located at Fort Eustis, Virginia and as the Chiefissuer (the “Nasdaq Change of Public Affairs for the US Army Headquarters based in Washington, DC. Maj. Gen. (Ret) Frost also served as the Deputy Commanding General for Support for the US Army, Deputy DirectorControl Rule”). Nasdaq may deem a change of Operations for the US Department of Defense and the Director of Operations for the US Army Pacific Headquarters. He deployedcontrol to Bosnia-Hercegovinaoccur when, as a company commander in 1995 and deployed twice to Iraq as commanderresult of an 800 person Cavalry Squadron operating in Tal Afar duringissuance, an investor or a group would own, or have the Surge in 2006-7, and as commander of a 5K person Stryker Brigade Combat Team operating in Diyala, Salah ad Din, and Kirkuk provinces in 2010-11. Additionally, he deployed as Director of Operations of a 4,000 person airborne brigade task force in Afghanistan in 2002-3. In additionright to a Bachelor of Science Degree in Human Resources Management from the United States Military Academy at West Point, Maj. Gen. (Ret) Frost holds advanced degrees from Webster University and the U.S. Army War College in Human Resources Development and National Security Strategy, respectively. He is the recipientacquire, 20% or more of the Distinguished Service Medal x2, Defense Superior Service Medal, Legionoutstanding shares of Merit x3, Bronze Star Medal x3, Air Medal, Army Commendation Medal x6 including one for Valor, Combat Infantryman Badge, Master Parachutist Badgecommon stock or voting power and Ranger Tab. He is a Certified Project Director and issuch ownership or voting power would be the recipientlargest ownership position of the U.S. Departmentissuer. Currently, the Services Agreement entered with Aggia contains a provision that restricts the amount of State Meritorious Honor Awardshares of common stock to be issued to Aggia to not exceed 19.99% of the outstanding shares of common stock as of such applicable date and accordingly their beneficial ownership cannot exceed that percentage. In order for reconstruction, civic and humanitarian achievements while serving in Iraq. Based on his vast business and financial experience withshares of common stock to be fully issued as contemplated by the militaryServices Agreement stockholder approval is required because, for purposes of the Nasdaq Change of Control Rule, the resulting ownership of our common stock for Aggia could potentially represent 49.999% of all outstanding shares of common stock as well as his business experience, we have deemed Maj. Gen (Ret) Frost a fit to serve onof the Board.closing date.

Philip Balatsos. Since 2016, Mr. Balatsos has workedWe seek your approval of Proposal No. 3 in order to satisfy the restaurantrequirements of the Nasdaq Change of Control Rule with respect to the issuance of all of the Shares pursuant to the Services Agreement entered with Aggia.

Compensation. Our Common Stock is listed on the NASDAQ Capital Market and, hospitality industries. In 2018, Mr. Balatsos foundedas such, we are subject to the NASDAQ Stock Market Rules. NASDAQ Listing Rule 5635(c) requires shareholder approval for certain equity compensation arrangements involving the issuance of common stock by a company to its officers, directors, employees, or consultants (the “Nasdaq Compensation Rule”). Consequently, in order to comply with NASDAQ Listing Rule 5635(c) and has served asto satisfy the owner operatorclosing conditions under the Services Agreement, we are seeking shareholder approval of LAPH Hospitality which operates a café/catering business and also serves asthe issuance of shares of Common Stock to Aggia, a consultant providing financial, purchasing and usage analysis as well as rollout services pertaining to ordering, invoicing and inventorying systems. From 2016 through 2018, Mr. Balatsos held various positions with Barteca Restaurant Group including Assistant General Manager and Purchasing Manager. Prior to 2016, Mr. Balatsos held various position on Wall Street for 16 years including Vice President, Foreign Exchange Sales/Trading for Credit Suisse, Director, Foreign Exchange Hedge Fund Sales for Barclays Capital and Financial Advisor for Stifel Nicolaus & Co. Mr. Balatsos graduated from Skidmore College in 1999 with a Bachelor of Science in Business Administration and from Institute of Culinary Education in 2016.Sadot LLC, our wholly owned subsidiary.

Information ConcerningWe seek your approval of Proposal No. 4 in order to satisfy the Board and Corporate Governancerequirements of the Nasdaq Compensation Rule with respect to the issuance of all of the Shares pursuant to the Services Agreement entered with Aggia.

Meetings ofChange in the Board of Directors

The boardCompany’s existing Bylaws provides that the number of directors met 9 times duringshall be fixed as the fiscal year ended December 31, 2020. The audit committee met 4 times,Board of Directors may from time to time designate. Pursuant to the compensation committee acted by unanimous written consentServices Agreement, subject to the below net income thresholds, Aggia will have the right to nominate the Designated Directors to the Board, seven timesof which will meet the independence requirements of the NASDAQ Capital Market and the nominating and corporate governance committee met seven times. Each memberCompany will take such actions as reasonably required to name the directors which Aggia has the right to nominate to the Board. Pursuant to the terms of the boardServices Agreement, Aggia nominated Benjamin Petel as the Initial Director. As it was not feasible for Aggia to nominate Mr. Petel at the Closing, pursuant to the terms of directors, attended at least 75%Addendum 1, the parties agreed that Mr. Petel will be deemed to be the Initial Director and the “Managing Member Representative” for all purposes of the aggregateServices Agreement until such time as the parties mutually agree that it is feasible for Aggia to nominate Mr. Petel as the Initial Director. Mr. Petel was appointed to the Board on December 27, 2022. Other than as set forth in Addendum 1, the Services Agreement remains in full force and effect.

Upon Sadot generating an initial $3.3 million in net income, Aggia shall nominate two additional persons as directors of the Board. Upon Sadot generating a total of $6.6 million in net income, Aggia shall nominate two additional persons as directors of the Board. Upon Sadot generating a total of $9.9 million in net income, Aggia shall nominate three additional persons as directors of the Board. All candidates as Designated Directors will be subject to the reasonable acceptance of the Board and appropriate background checks.

We are seeking shareholder approval of Proposal No. 5 regarding the Services Agreement providing Aggia with the right to nominate the Designated Directors subject to the net income thresholds.

Approval of the 2023 Equity Incentive Plan

Separately, in a matter unrelated to the Services Agreement or the Sadot transaction, we are asking our stockholders to approve our 2023 Equity Incentive Plan. On December 29, 2022, our Board approved the Equity Incentive Plan, subject to stockholder approval. When our stockholders approve the 2023 Equity Incentive Plan, we will be able to issue approximately an additional 2,500,000 shares above the number of meetingsshares already subject to outstanding equity awards to employees.

Effect of our boardthe Vote

Upon approval of directors. We encourage all of our directorsthe proposals described in this proxy statement, we will be able to issue the Shares to Aggia when earned and nominees for directorwe will be able to attend our annual meeting of stockholders; however, attendance is not mandatory.fully reserve the Shares issuable to Aggia pursuant to the Services Agreement.

| 8 |

Board Leadership Structure and Board’s Role in Risk OversightPROPOSAL NO. 1

Kevin Mohan is the ChairmanAPPROVAL of THe SERVICES AGREEMENT PROPOSALAND THE SADOT TRANSACTION

The stockholders of the Board. The Chairman has authority, among other things,Company are being asked to preside over Board meetingsapprove the Services Agreement and set the agenda for Board meetings. Accordingly, the Chairman has substantial ability to shape the work of our Board. We currently believe that separationSadot Transaction. For a detailed discussion of the rolesterms and conditions of Chairmanthe Services Agreement and Chief Executive Officer ensures appropriate oversight bythe Sadot Transaction see the section entitled “Background of The Transaction.” A copy of each of the Services Agreement is attached to this proxy statement as Annex A. In addition, we have attached a copy of the Operating Agreement for Sadot LLC, our wholly owned subsidiary, as Annex C.

After evaluating the transaction, the Board of our businessDirectors determined that the Services Agreement and affairs. However, no single leadership model is right forthe Sadot Transaction are advisable and in the best interests of the Company and recommended the transaction.

The Sadot Transaction contemplated by the Services Agreement will be terminated unless all companies and at all times.of the proposals are approved. The Board recognizes that dependingterm of the Services Agreement shall commence on the circumstances, other leadership models,Effective Date and continue until terminated. The Services Agreement will automatically terminate in the event that the any of the proposals fail to receive the requisite vote needed to approve such asmatters. In the appointmentevent the Services Agreement is terminated, then, at the election of Aggia, Sadot will make a payment to Aggia equal to the net income generated by Sadot from the Closing Date through the date of such termination less any supportable incremental cost that the Company and Sadot would not have incurred that is attributable to Sadot or Aggia will retain the Shares it has received prior to such termination. Further, upon termination, the Company shall sell to Aggia its membership interest in Sadot for a purchase price of $1.00 in total.

The approval of Services Agreement and the Sadot Transaction requires the affirmative vote of a lead independent director, might be appropriate. Accordingly,majority of the Board may periodically reviewtotal votes cast on the proposal at the special meeting, either in person or by proxy.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL NO. 1.

| 9 |

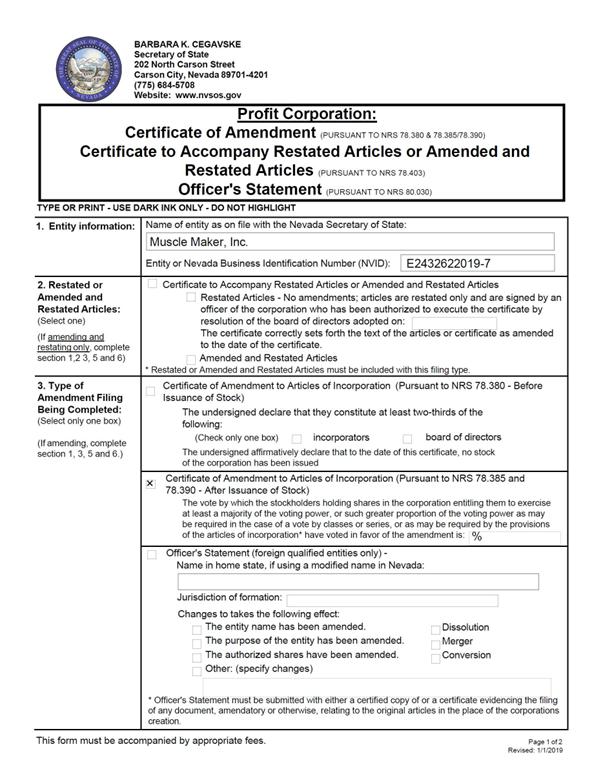

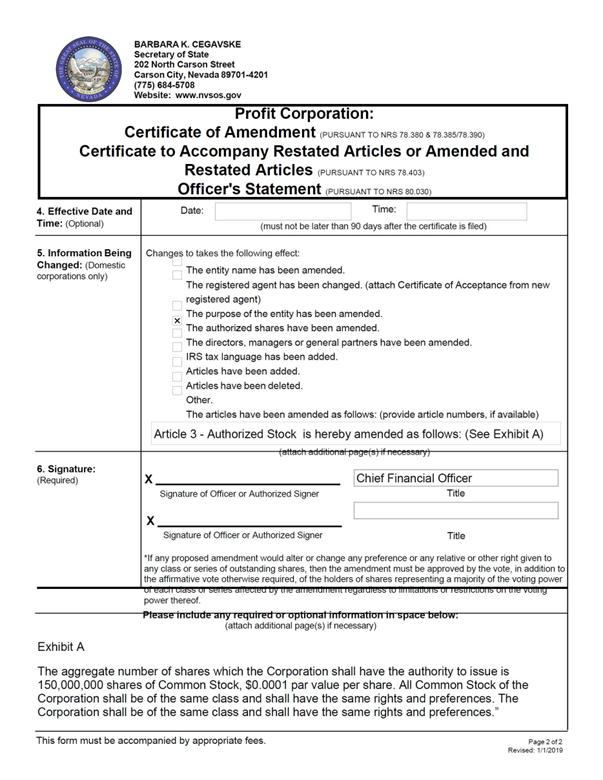

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO THE COMPANY’S

ARTICLES OF INCORPORATION, AS AMENDED,

TO INCREASE THE AUTHORIZED COMMON STOCK FROM 50,000,000 TO 150,000,000

We are seeking approval to amend the Articles of Incorporation, as amended, to increase the authorized number of shares of our Common Stock from 50,000,000 to 150,000,000. The form of the Certificate of Amendment to the Articles of Incorporation is attached to this Proxy Statement as Annex D. The discussion herein is qualified in its leadership structure.entirety by the full text of such amendment, which is incorporated herein by reference.

We currently have 50 million shares of authorized common stock. As of the Record Date, there were approximately 29,318,520 million shares of Common Stock issued and outstanding. In addition, following the qualificationas of the offering,Record Date, there were 18,033,640 million shares of Common Stock reserved for issuance upon exercise of or conversion of outstanding warrants and 312,500 million shares of Common Stock reserved for issuance upon exercise of outstanding stock options. Based on the Board will hold executive sessions in which only independent directorsnumber of outstanding and reserved shares of Common Stock described above, we have approximately 1,804,268 shares of Common Stock remaining available for issuance as of the Record Date. In addition, an aggregate of 14,424,275 Shares are present.issuable to Aggia pursuant to the Services Agreement.

Our Board of Directors believes that the increase in authorized shares of Common Stock is generally responsible for the oversight of corporate risk in its review and deliberations relatingcritical to our activities. Our principal source of risk falls into two categories, financial and product commercialization. The audit committee oversees management of financial risks;ongoing efforts to raise capital to fund our Board regularly reviews information regarding our cash position, liquidity and operations as well as to issue the risks associatedShares to Aggia pursuant to the Services Agreement. Even with each. The Board regularly reviewsour current cash balances, we may still need to raise additional capital and may elect to do so through the issuance of equity or equity-linked securities. Without an increase in the authorized shares of Common Stock, we would be unable to do so. With the increase, we will have sufficient authorized but unissued shares from which to issue additional shares of Common Stock, or securities convertible or exercisable into shares of common stock, in equity financing transactions. In addition, we believe we may need to seek approval of additional shares of Common Stock for awards to employees under future equity incentive plans, results and potential risks relatedwhich will be subject to our system-wide restaurant growth, brand awareness and menu offerings. Our Compensation Committee is expected to oversee risk management as it relates to our compensation plans, policies and practices for all employees including executives and directors, particularly whether our compensation programs may create incentives for our employees to take excessive or inappropriate risks which could have a material adverse effect on the Company.stockholder approval.

RoleFor these reasons, we are seeking stockholder approval to amend Article III of Board in Risk Oversight Processour Articles of Incorporation, as amended, to increase the number of authorized shares of common stock of the Company from 50 million shares to 150 million shares.

Risk assessmentIn considering the number of authorized shares of Common Stock the Board is requesting the stockholders approve, it took into account various factors, including the number of shares that need to be reserved for exercise of outstanding warrants and oversight are an integral partconvertible securities including the 14,424,275 shares of our governanceCommon Stock that may be issued to Aggia pursuant to the Services Agreement, the number of shares issuable upon exercise of all stock options and management processes. Our board of directors encourages managementother equity awards outstanding and any shares that the Company may request to promote a culturebe included in equity incentive plans that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings, and conducts specific strategic planning and review sessions duringmay be implemented in the year that include a focused discussion and analysisfuture, subject to required stockholder approval. In addition, the Company will reserve for the potential issuance of the risks facing us. Throughout14,424,275 Shares Aggia pursuant to the year, senior management reviews these risks with the board of directors at regular board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.Services Agreement.

Our boardIf approved by our stockholders, the additional authorized shares of directors does not have a standing risk management committee, but rather administers this oversight function directly throughCommon Stock would be available for issuance for any proper corporate purpose as determined by our board of directors as a whole, as well as through various standing committees of our board of directors that address risks inherent in their respective areas of oversight. While our board of directors is responsible for monitoring and assessing strategic risk exposure, our audit committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The audit committee also monitors compliance with legal and regulatory requirements and considers and approves or disapproves any related person transactions. Our nominating and governance committee monitors the effectiveness of our corporate governance policies. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Independence of Board of Directors and its Committees

We intend to apply to list our common stock onwithout further approval by the on NASDAQ capital market. Understockholders, except as required by law, the rulesListing Rules of NASDAQ, “independent” directors must make up a majority of a listed company’s board of directors. In addition, applicable NASDAQ rules require that, subject to specified exceptions, each member of a listed company’s audit and compensation committees be independent within the meaning of the applicable NASDAQ rules. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act.

Our board of directors currently consists of seven (7) members. Our board of directors has determined that A.B. Southall III, Paul L. Menchik, General (ret) Malcolm Frost, Jeff Carl, Stephen Spanos and Philip Balatsos, qualify as independent directors in accordance with the Nasdaq Capital Market (“Nasdaq”) listing requirements. Kevin Mohanor the rules of any other national securities exchange on which our shares of Common Stock are listed.

The additional shares of Common Stock to be authorized will have rights identical to our currently outstanding Common Stock. The proposed amendment will not affect the par value of the common stock, which will remain at $0.0001 per share. Under our Articles of Incorporation, as amended, our stockholders do not have preemptive rights to subscribe to additional securities that we may issue; in other words, current holders of Common Stock do not have a prior right to purchase any new issue of our capital stock to maintain their proportionate ownership of Common Stock. If we issue additional shares of Common Stock or other securities convertible into Common Stock in the future, it will dilute the voting rights of existing holders of Common Stock and will also dilute earnings per share and book value per share.

The proposed amendment to our Articles of Incorporation, as amended, to increase the number of our authorized shares of common stock could, under certain circumstances, have an anti-takeover effect, although this is not considered independent. Nasdaq’s independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three (3) years, one of our employees and that neither the director nor any of his or her family members has engaged in various types of business dealings with us. In addition, as required by Nasdaq rules, our board of directors has made a subjective determination as to each independent director that no relationships exist that, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our board of directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors or executive officers.

As required under Nasdaq rules and regulations, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present.